Is GoDaddy domain appraisal accurate in 2026?

This is one of the most common questions domain buyers and sellers ask before trusting an automated valuation. GoDaddy’s domain appraisal tool is widely used across marketplaces, negotiations, and listings—but popularity does not guarantee accuracy. Understanding how GoDaddy domain appraisal works, where it helps, and where it fails is critical before relying on its numbers for real buying or selling decisions.

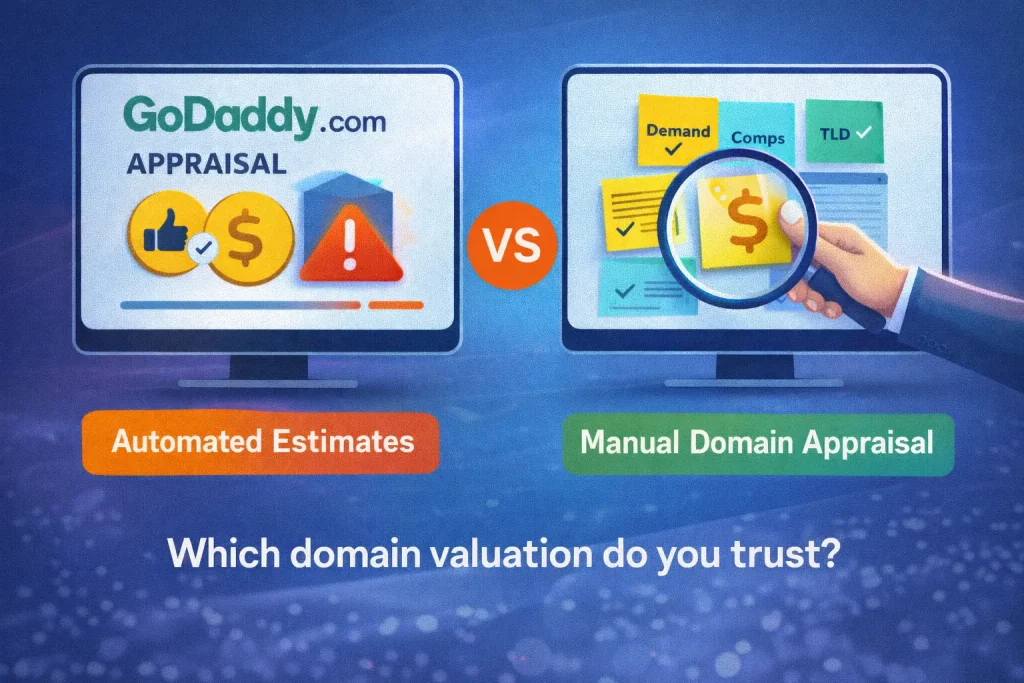

In this guide, we compare GoDaddy’s automated domain appraisal with real market behavior, verified comparable sales, and professional manual valuation logic to show when GoDaddy’s estimates are useful—and when they can be misleading.

Table of Contents

What Is GoDaddy Domain Appraisal?

GoDaddy Domain Appraisal is an automated valuation tool that generates an estimated dollar value for a domain name based on algorithmic signals.

It typically analyzes:

- Keyword presence

- Historical sales patterns

- Domain length

- Extension (TLD)

- Traffic estimates

- General market trends

The result is a single number, generated instantly, with no human review.

That speed is both its strength and its weakness. But the real question is GoDaddy domain appraisal accurate?

Is GoDaddy Domain Appraisal Accurate?

Sometimes useful. Often misleading. Never complete.

GoDaddy appraisal is not designed to provide a true market valuation. It is designed to offer a rough indicator—nothing more. It was never meant to be accurate, Is GoDaddy domain appraisal accurate that is what all the domainers are asking around.

For basic keyword domains, it may land in the right ballpark.

For brandables, acronyms, short names, and premium domains, it frequently misses the mark—sometimes by thousands.

Where GoDaddy Appraisal Gets It Right

To be fair, GoDaddy appraisal does have legitimate use cases.

✅ 1. Broad Keyword Detection

If a domain contains a clear, high-demand keyword (insurance, loans, jobs, crypto), the tool can recognize basic commercial relevance.

✅ 2. Quick Elimination Tool

It helps filter out obviously weak domains when scanning large lists.

✅ 3. Entry-Level Reference

For beginners, it provides a starting point to understand that not all domains are equal.

In short: it’s a decent screening tool, not a valuation tool.

Where GoDaddy Domain Appraisal Fails

This is where most buyers and sellers get misled.

❌ 1. It Cannot Measure Brandability

Brand value is subjective, contextual, and human-driven.

GoDaddy appraisal cannot evaluate:

- Memorability

- Pronunciation

- Visual clarity

- Startup appeal

- Emotional resonance

As a result:

- Strong brandables are often undervalued

- Weak but keyword-heavy names are inflated

❌ 2. It Misuses Comparable Sales

The algorithm pulls loosely related sales, often ignoring:

- Industry context

- Buyer type

- Brand positioning

- Liquidity differences

This leads to false equivalence, where unrelated domains influence pricing.

For verified sales data, serious investors rely on tools like

👉 https://namebio.com

👉 https://dnjournal.com

❌ 3. It Overvalues Weak Extensions

GoDaddy appraisal consistently inflates:

- .xyz

- .info

- .site

- novelty TLDs

Meanwhile, it often undervalues:

- Short .com domains

- Clean acronyms

- High-liquidity brandables

The market reality does not support these valuations.

❌ 4. It Ignores Liquidity

Liquidity—how fast a domain can realistically sell—is one of the most important valuation factors.

GoDaddy appraisal does not measure:

- Investor demand

- Wholesale market behavior

- Resale velocity

A domain “worth” $5,000 that takes 10 years to sell is not a $5,000 asset.

❌ 5. It Encourages Overpriced Domains

One of the biggest problems: sellers use GoDaddy’s number as justification.

This is how overpriced domains are born.

If you see a seller say:

That is a red flag, not proof.

Actual end-user value can easily exceed GoDaddy’s estimate.

Real-World Comparison: What’s Fair vs Overpriced in 2026

Example 1: CRTR.com (4-letter .com)

Why it’s often not overpriced (if priced correctly):

- 4L .coms have an established resale market and liquidity tiering.

- Value depends on: pronounceability, pattern quality, acronym demand, and buyer pool size.

- A “random 4L” and a “clean 4L” don’t trade in the same ranges—even if both are short.

Fast test (30 seconds):

- If similar 4-letter .com patterns are selling consistently, pricing is defensible.

- If the seller is asking a premium price without comps, it becomes an overpriced domain.

What to check (public proof):

- Compare against reported 4-letter .com sales examples and patterns.

- Validate with NameBio comps for similar 4L structures

Example 2: DCTM.com (4-letter .com, acronym-style)

Why automated tools often misread this category:

- Acronym value comes from real-world abbreviation use, industry fit, and buyer scarcity—not keyword volume.

- Strong acronyms can command serious end-user premiums, even when the keyword tool signals are weak.

Fast test (30 seconds):

- Search NameBio for similar 4L acronym sales and patterns (same “feel,” not just “same letters”).

- If sellers price it like an average 4L with no meaning, it may be underpriced.

- If sellers price it like a top-tier acronym with no market evidence, it may be overpriced.

What to check (public proof):

- Use NameBio to pull comparable 4L acronym sales history and ranges.

- Use DNJournal archives to understand how higher-end sales are typically reported/validated in the industry.

Example 3: Pandaa.com (brandable, “double-a” style)

Where overpriced domains happen most often:

- Brandables are frequently overpriced because sellers assume “it sounds nice” = “it’s worth $xx,xxx”.

- The market pays for brandables when they pass:

- spelling clarity

- pronunciation

- clean look

- strong category fit

- comps support

Fast test (30 seconds):

- If the domain requires explanation (“it’s like Panda but…”), the buyer pool shrinks fast.

- If comps for similar brandable animal/word-variant names are weak, then a high BIN price is usually an overpriced domain.

What to check (public proof):

- Check NameBio for similar brandable patterns (animal names, altered spellings, double-vowel variants).

GoDaddy Appraisal vs Manual Domain Appraisal

| Factor | GoDaddy Appraisal | Manual Appraisal |

|---|---|---|

| Speed | Instant | 24–48 hours |

| Brandability | ❌ | ✅ |

| Comps Accuracy | ❌ | ✅ |

| Liquidity Analysis | ❌ | ✅ |

| Buy/Sell Guidance | ❌ | ✅ |

| Negotiation Support | ❌ | ✅ |

A proper domain appraisal evaluates:

- Keyword demand

- Brand potential

- Comparable sales

- Market trends

- TLD strength

- Liquidity

- Real buyer behavior

You can see the full professional framework here:

👉 https://www.domainverdict.com/domain-appraisal/

When Should You Use GoDaddy Appraisal?

Use it when:

- Scanning large lists

- Eliminating weak names

- Getting a rough directional signal

Do not use it when:

- Buying premium domains

- Pricing for sale

- Negotiating with buyers

- Evaluating brandables

- Making investment decisions

For that, you need real analysis.

What to Use Instead in 2026

A smarter workflow looks like this:

- Automated tools for screening

- Verified sales data (NameBio, DNJournal)

- Manual appraisal for pricing decisions

For brandable domains and investor-grade analysis, marketplaces like

show real-world naming trends and buyer behavior that algorithms miss.

Final Verdict: Is GoDaddy Domain Appraisal Accurate?

GoDaddy domain appraisal is not wrong—but it is incomplete. GoDaddy domain appraisal accurate is when

It works as:

- A rough indicator

- A filtering tool

- A beginner reference

It fails as:

- A pricing authority

- A negotiation anchor

- A valuation substitute

Is GoDaddy domain appraisal accurate? We can use it as an indicator but If money is on the line, relying on automated numbers alone is risky.

A professional domain appraisal gives you clarity, confidence, and leverage—things no algorithm can replicate.

Is GoDaddy appraisal reliable for selling domains?

No. It often leads to overpricing or underpricing.

Why do sellers quote GoDaddy values?

Because it’s convenient—not because it’s accurate.

Can GoDaddy appraisal undervalue domains?

Yes, especially short .coms and brandables.

Should I ignore GoDaddy appraisal completely?

No—but treat it as a signal, not a verdict.